Webinar on Auditing Green Fiscal Policy Tools – Key Findings & Recommendations by SAIs on 14 December 2023

07.12.2023

The meeting slides are available here.

In the spirit of enhancing knowledge and understanding how to assess the effectiveness and impact of green fiscal policy tools on environment and climate, the European Court of Auditors in collaboration with the INTOSAI WGEA are organizing a webinar (an audit practice sharing session) on Auditing Green Fiscal Policy Tools - Key Findings and Recommendations by Supreme Audit Institutions.

The webinar will take place on Teams on Thursday 14 December 3:00-4:30 pm (UTC +1:00).

Click here to join the webinar

Meeting ID: 333 995 567 15

Passcode: jkKvaS

Download Teams | Join on the web

Key topics and speakers in the webinar are:

- Environmental taxes study | Sarah Pearcey (UK’s National Audit Office)

- Lessons learned from auditing major energy and environmental spending | Quindi Franco (U.S. Government Accountability Office)

- Review on energy taxes and subsidies and ongoing audit on plastics own resource | Lucia Rosca and Jose Parente (European Court of Auditors)

- Overview on environmentally harmful subsidies | Alar Jürgenson (National Audit Office of Estonia)

- Questions/Answers/Comments session

The webinar will be facilitated by Joanna Kokot (European Court of Auditors). Should you have any inquiries or technical issues, please contact the Secretariat at intosaiwgea@vtv.fi.

We look forward to seeing you online!

Background

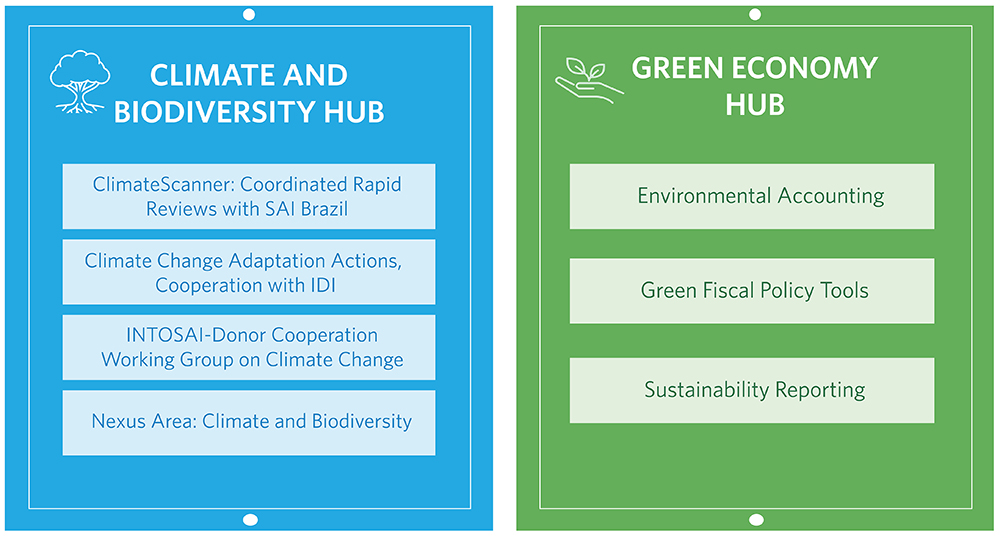

The session is organized as part of the Green Fiscal Policy Tools project which is one of the three projects within the Green Economy Hub of the INTOSAI WGEA’s 2023-2025 Work Plan.

Green fiscal tools include a series of market-based instruments that encourage the development and use of green technologies. On the example of incorporating renewable energy in countries’ energy mix, direct or indirect government expenditures can be used to incentivize increasing the share of renewable energy. Hence, the following instruments can be considered as green fiscal tools:

- environmental taxes, charges and subsidies

- fiscal policies or reforms to raise public revenues

- fiscal incentives and financial mechanisms that can leverage private financing for green investments

- promotion of sustainable finance through a common classification system establishing what qualifies for environmentally sustainable activities

- alignment of government expenditure with environmental goals and enhancing the effectiveness of public spending, or mainstreaming climate in the public budget

- proposing legislation on energy, plastic, pollution, soil etc. to provide incentives for green investments

- emission trading system

The project aims to enhance knowledge and understand how to assess the effectiveness and impact of green fiscal policy tools on environment and climate by establishing a series of short webinars, a recorded podcast as well as reference resources including for instance definitions and descriptions of green fiscal policy tools, relevant criteria, and key questions for auditors.