Fees are typically payments made in exchange for a service or penalties levied for an activity. They are a type of price and market-based instrument that governments use to alter behavior by changing prices in the market. For example, some governments charge fees to access public wilderness for recreational purposes, such as hiking and camping. Governments can also use fees to increase funding to use for other purposes, including environmental projects.

A fee can also be a refundable surcharge. For example, a deposit-refund system (also known as an advance deposit fee) places a surcharge on a product at the point of purchase. The surcharge is refunded when the product is returned or recycled, which provides an incentive for consumers to do so. This system is commonly used with beverage containers and can be used for other materials such as batteries, tires, and electronics. Deposit-refund systems can be voluntary or required by law.

Although fees provide incentives, they cannot guarantee environmental outcomes. For example, the incentive may not be enough to cause a change in behavior or it may result in unintended consequences that undermine the desired outcome. As a result, they cannot ensure governments meet environmental targets.

European Union: Polluter Pays Principle

The European Court of Auditors (ECA) performed an audit between March 2020 and March 2021 to evaluate how well European Union (EU) and its member states applied the Polluter Pays Principle in four EU environmental policy areas: industrial pollution, waste, water, and soil.

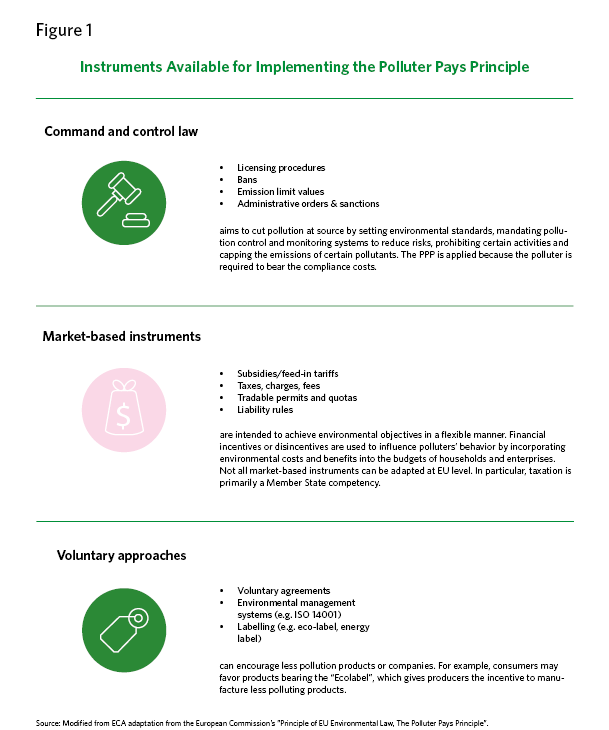

The Polluter Pays Principle is one of the key principles underlying the EU’s environmental policy and various laws, directives, and regulations. Under this policy, polluters bear the costs of their pollution, including the cost of measures to prevent, control, and remedy pollution, as well as the costs that the pollution imposes on society. Applying the principle provides incentive for polluters to avoid damaging the environment and holds them responsible for the pollution that they cause.

The ECA examined relevant EU spending, examined reports and other actions related to how a sample of member states applied the principle, and analyzed the performance of a sample of environmental remediation projects. The ECA compared its findings against various environmental directives.

The ECA found that the principle was applied to varying degrees in the four environmental policy areas and that, overall, its application was incomplete. For example, the ECA found that

The report included three recommendations, primarily related to strengthening EU legislation and the Environmental Liability Directive, which sets a legal framework for environmental liability that holds polluters who damage the environment responsible for paying for remediation. ECA also recommended protecting funds from being used to finance projects that polluters should fund.

Canada: Carbon Pricing

The Office of the Auditor General of Canada performed an audit to determine whether Environment and Climate Change Canada ensured that carbon pricing systems were applied effectively, fairly, and transparently. Environment and Climate Change Canada is the lead department on climate change and directs implementation of carbon pricing systems.

In 2018, Canada’s Greenhouse Gas Pollution Pricing Act came into force and required that all provinces and territories implement carbon pricing systems that meet minimum national standards or be subject to the federal pricing system. These pricing systems impose fees on polluters, encouraging more environmentally sustainable decisions and placing responsibility for pollution costs on polluters.

Overall, the Office of the Auditor General found that Environment and Climate Change Canada ensured carbon pricing systems were in place in all provinces and territories by 2019. However, weaknesses in those systems could limit Canada’s ability to meet its emission reduction targets. For example, because of weak minimum national standards for large emitters, the department recommended strengthening less effective carbon pricing programs that some provinces had developed.

The department also did not have the information it needed to understand the effectiveness of the carbon pricing systems. In 2021, the department updated federal requirements, but the update did not fully address the shortcomings of the large-emitter programs.

The auditors made four recommendations, primarily related to assessing the program and collecting additional information.

Criteria