Green loans enable borrowers to fund existing and new projects that contribute to an environmental objective. They typically offer better terms than a private loan in exchange for the funds being used for a specified outcome. Green loans can contribute to aligning lending and environmental objectives, such as building solar plant projects.

In some cases, a government may lend money directly to a borrower. In other cases, a government may offer a loan guarantee, in which it backs a loan issued by a bank in case the borrower defaults.

Loans and loan guarantees can expose governments to financial losses if borrowers default. They also may affect economic growth and technological advancement by selectively encouraging development in certain technologies.

Case studies

United States: Clean Water Infrastructure Revolving Fund Program

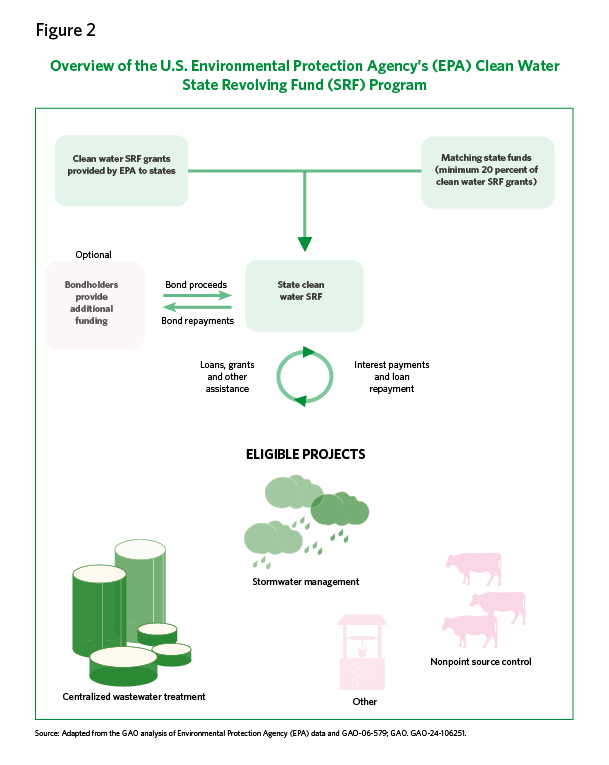

The U.S. Government Accountability Office (GAO) reviewed the U.S. Environmental Protection Administration’s (EPA) revolving fund program for repairing and replacing clean water and wastewater infrastructure across the nation. EPA uses a formula to allot grants to states, which use it to establish their own revolving funds from which they make low-interest loans or grants to local communities or utilities to repair or replace such infrastructure. EPA has estimated that over $630 billion will be needed to repair and replace such infrastructure nationwide through 2044.

To examine options for the revolving fund’s allotment formula, GAO reviewed laws, regulations, and agency documents and analyzed EPA and U.S. Census data. It also interviewed EPA officials, state organizations, and officials from eight states selected based on geographic and other factors. GAO also convened a panel of seven experts to develop a formula using a multistep process.

GAO reported in 2024 that EPA allocates grants using a formula from 1987 that is set by statute and does not reflect states’ current populations and clean water needs. GAO also reported that the experts it convened developed a new formula that is largely based on states’ clean water needs. GAO suggested that the U.S. Congress consider revising the formula for EPA’s revolving fund program. GAO also recommended that EPA better assess states’ clean water needs.

United States: Energy Loan Programs

GAO audited the U.S. Department of Energy’s (DOE) Loan Programs Office, which administers loans and loan guarantees for certain renewable or innovative energy projects, as well as for more fuel-efficient vehicles and components. By the time GAO issued its report in 2014, DOE had made more than $30 billion in loans and guarantees.

GAO assessed the department’s loan monitoring policies by analyzing relevant regulations, policies, and guidance; prior audits; and DOE data, documents, and monitoring reports for a nonprobability sample of 10 loans and guarantees.

GAO found that the department made loans and loan guarantees and disbursed funds from 2009 through 2013 without a fully developed loan monitoring function. During this time, inconsistent adherence to policies limited assurance that the department was completing activities important to monitoring the loans and protecting the government's interest against borrowers defaulting. GAO made four recommendations, including that DOE completed policies for loan monitoring and evaluate the effectiveness of its loan monitoring.

Criteria