Resource taxes include all environment- and energy-related taxes, excises, and state fees that are recorded as taxes in national accounts. These include taxes on the use of pollutants or on the production of goods that result in pollution when used.

Resources taxes are intended to alter production decisions. For example, a pollution tax would disproportionately affect polluters, thereby providing an incentive for the producer to reduce pollution. Resource taxes can be either explicit (such as taxes directly on emissions) or implicit (taxes on inputs to production of a good or service).

Resource taxes can be a policy tool that has a wide effect but is less complex than other tools such as regulatory measures that may be more complex to implement and enforce. Taxes also raise revenues that can be used for other environmental or energy purposes, including environmental improvement schemes.

Resource taxes have many of the same potential challenges as other taxes, such as how to best distribute costs and benefits across society. If they are regressive, they can disproportionately affect the poorest people. Additionally, since they can only encourage behavioral changes, they cannot guarantee governments achieve their environmental goals.

Case studies

European Union: Energy Taxation, Carbon Pricing, and Energy Subsidies

The European Union’s (EU) European Court of Auditors (ECA) conducted a nonaudit review of how energy taxes, carbon pricing, and energy subsidies have contributed to achieving the EU’s climate goals. Among EU member states, renewable energy subsidies almost quadrupled from 2008 through 2019, but fossil fuels subsidies remained stable. Consequently, 15 member states spent more on subsidies for fossil fuels than for renewable energy.

ECA conducted the review to provide an independent view on energy taxation and climate change. As part of the review, the auditors reviewed legislation, proposed guidelines, national energy and climate plans, and relevant studies and reports; analyzed international and national energy tax data from 2008 through 2021; and interviewed European Commission staff and other experts.

ECA reported that while energy taxes, carbon pricing, and energy subsidies can be important drivers for achieving climate objectives, member states’ implementation of such fiscal tools has shortcomings. For example, certain energy sectors received significant energy tax reductions and exemptions, but the tax levels did not accurately reflect the extent to which different energy sources result in pollution (e.g., greenhouse gas emissions).

ECA also reported that after considering taxes and emission-trading allowances, the recent prices of energy products did not reflect the corresponding environmental costs of emissions. Moreover, fossil fuel subsidies remained relatively constant over the last decade despite commitments to phase them out. ECA found ongoing challenges with ensuring consistency in treatment of energy sectors, reducing fossil fuel subsidies, and reconciling climate objectives with social needs.

Republic of Slovenia: Environmental Water Tax

The Republic of Slovenia’s Court of Auditors reviewed the effectiveness of the country’s system of environmental taxes for water use from January 2016 through December 2020.

They reviewed relevant laws, regulations, and documents; gathered and analyzed data on water rights, pumped and sold volumes of drinking water, and environmental taxes for water use; conducted interviews with agency officials and stakeholders; and reviewed studies of individual cases by purpose of water use and volume of calculated and paid environmental taxes.

The Court of Auditors found that the system of environmental taxes for water use was not effective. For example, relevant laws did not set out criteria for determining which type of water right is subject to regulation. Also, the Ministry of the Environment and Spatial Planning did not issue regulations to determine a threshold above which a water permit must be obtained or criteria for determining the method and amount of payment for water rights. Consequently, water permit holders do not pay for water rights.

In addition, Slovenia’s laws and regulations do not specify criteria for determining prices of water reimbursement based on the type of water use or the estimated environmental costs related to each type of special water use. The government also did not have metrics to measure its achievement of water use goals. Furthermore, the ministry was inefficient in collecting environmental charges and did not properly plan for how to use the collected taxes.

United Kingdom: Environmental Tax Measures

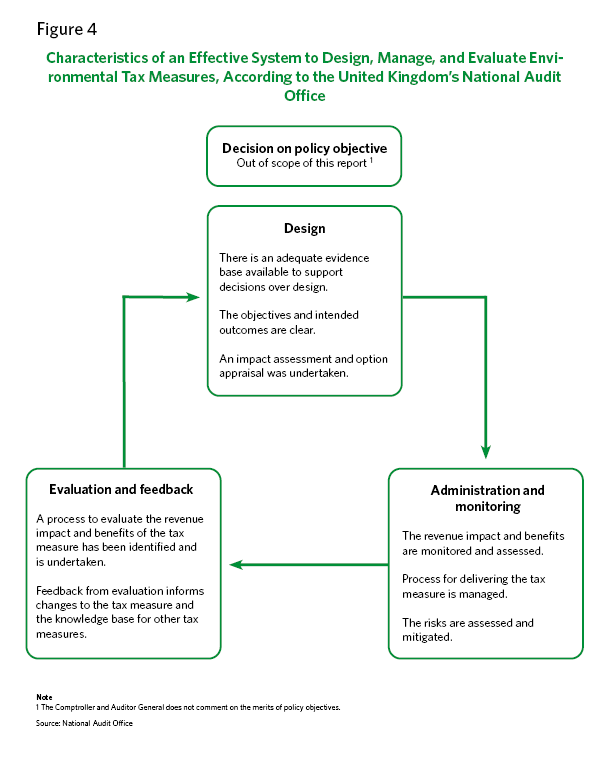

The United Kingdom’s National Audit Office (NAO) examined how the government’s relevant agencies manage tax measures with environmental objectives, including the work they did to design, monitor, and evaluate the measures. NAO also explored how Revenue and Customs uses resources to manage the relationship between the tax system and the government’s environmental goals.

To answer these questions, NAO conducted case studies of two established environmental taxes, an environmental tax being designed, and two tax reliefs and analyzed trends in environmental taxes. NAO completed the review in its role to examine the efficiency and effectiveness of agencies’ use of resources to fulfill responsibilities, including managing taxes.

Overall, NAO found that the relevant agencies had difficulty designing, monitoring, and evaluating environmental taxes and that more focus on monitoring and evaluation steps is needed. For example, NAO found that in designing tax structures, agencies took many of the expected steps such as consulting with stakeholders and considering implementation issues.

However, the agencies did not specify measures or data for evaluating the success of the taxes or set performance goals. In the monitoring and evaluation stages, NAO found that agencies tended to focus more on monitoring the revenue raised rather than the environmental impact achieved, which can be difficult to evaluate. Moreover, agencies did not evaluate the cumulative impact of all of tax tools together (e.g., tax reliefs, existing tax system). It is important to understand this impact in order to achieve broader national environmental goals.

Criteria