Green tax incentives and credits, which reduce the amount of tax owed to the government, can lower the price of goods or services to encourage consumers and producers to meet environmental goals and reduce environmental harm, such as by reducing pollution.

Incentives and credits can alter production decisions by encouraging producers to reduce, or pay for, behaviors that negatively affect the environment. They can persuade producers to conduct environmentally friendly projects in exchange for reducing their tax liability. They also can nudge a consumer to purchase a more environmentally friendly product that they otherwise would have thought was too expensive.

As result, green tax credits and incentives reduce a producer’s or consumer’s tax liability while increasing environmentally friendly behaviors. Green tax incentives and credits may be used to encourage behaviors such as

However, green tax incentives and credits can lead to unintended consequences. They can be an inefficient use of resources, especially if the reason for the initial tax incentives or credit becomes no longer applicable. They also can affect economic growth and technological advancement by discouraging purchases or investments in more environmentally friendly alternatives.

Tax incentives and credits present many of the same potential challenges as other taxes, such as how best to distribute costs and benefits across society. If they are regressive, they can disproportionately affect the poorest people. Additionally, since they can only encourage behavior changes, they cannot guarantee governments achieve their environmental goals.

Case studies

Estonia: Environmentally Harmful Subsidies

Estonia’s National Audit Office (NAO) reviewed whether and how the Estonian government has identified and assessed environmentally harmful economic measures (e.g., tax incentives) and their impact, as well as the steps the government has taken to modify or eliminate those harmful measures.

For this review, NAO analyzed other countries’ efforts to identify and assess environmentally harmful subsidies, interviewed experts from those countries, and convened a focus group of relevant Estonian government officials.

In April 2022, NAO reported that the government had not identified environmentally harmful subsidies or assessed their impact. NAO also noted that the Estonian government had not set out to amend or gradually phase out those measures. NAO made four recommendations, including that the government (1) designate a lead governmental authority for identifying environmentally harmful subsidies and (2) adapt existing international methodologies for identifying and assessing those subsidies to Estonia’s needs.

Netherlands: Vehicle Taxes

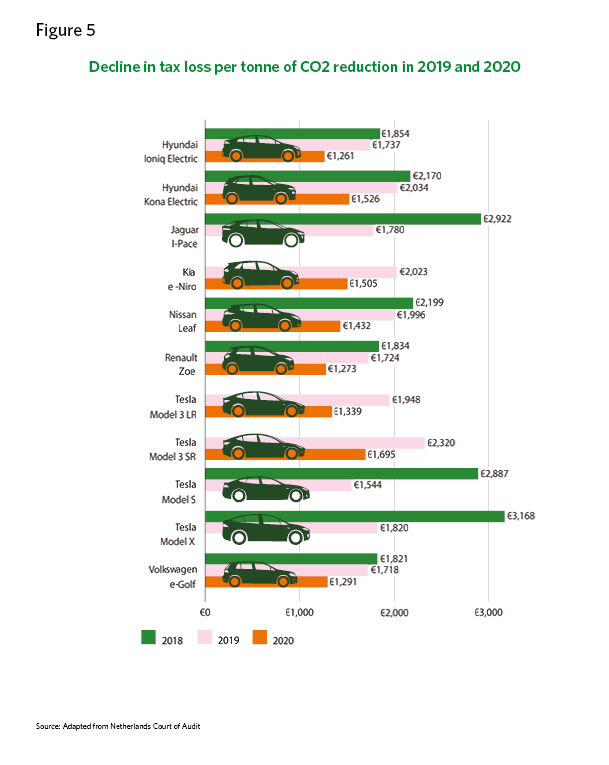

The Netherlands Court of Audit audited how electric cars and commercial vehicles have affected tax revenues, air quality, and the climate. Auditors analyzed the impacts of 11 models of zero-emissions cars on tax revenues and carbon dioxide emissions and compared it to the impacts of petroleum and diesel cars. They also analyzed special schemes for light commercial vehicles and how those schemes affected air quality and climate goals.

In June 2020, the Court of Audit reported that zero-emissions cars lead to considerable tax losses per vehicle and per ton of carbon dioxide reduction. It also reported that tax incentives for zero-emissions cars are an expensive policy instrument to reduce carbon dioxide emissions.

The Court of Audit made five recommendations, including that the government review vehicle taxation, adapt vehicle taxes to prevent zero-emissions vehicles from reducing the tax base, and evaluate whether it should continue to use vehicle taxes as a policy instrument.

Switzerland: Carbon Dioxide Tax Exemption

The Swiss Federal Audit Office evaluated the country’s carbon dioxide tax exemption. Switzerland imposes a carbon dioxide tax for fuels used by businesses and consumers. Businesses in energy-intensive sectors can claim an exemption from the tax if they take action to reduce their greenhouse gas emissions.

In performing the audit, the auditors reviewed documents and conducted interviews, surveys, and case studies.

In October 2023, the Audit Office reported that, in general, businesses were satisfied with the carbon dioxide tax exemption and stated that it had reduced their costs and energy use. However, the auditors also noted that the emission reduction requirements for businesses to claim the tax exemption were low and had remained unchanged for a decade even though the carbon dioxide tax had tripled in that time.

They made seven recommendations, including that the government establish more ambitious emission reduction targets for businesses and set higher penalties for those that do not reach targets.

United States: Electricity Generation Projects

The U.S. Government Accountability Office (GAO) audited state and federal supports for the development of utility-scale electricity generation projects. States and the federal government have supported the development of electricity generation projects in a variety of ways.

GAO analyzed relevant legislation, federal budget and program data, and interviewed stakeholders, including project developers and experts. GAO also surveyed state regulatory commissions about state policies. In addition, GAO modeled how reducing federal tax expenditures could affect project finances.

In 2015, GAO reported that in the years leading up to its audit, state and federal supports had targeted renewable energy sources, such as solar and wind, although there were some supports for projects that used traditional sources (natural gas, coal, and nuclear).

GAO found that state policies helped the development of utility-scale electricity generation projects—particularly renewable projects. However, while federal financial supports helped the development of new projects, limited data limited the government’s ability to understand the effectiveness of federal tax expenditures. GAO recommended that the U.S. Congress change federal law to direct the agency responsible for tax administration to collect and publicly report relevant data.

Criteria